Subscriber Benefit

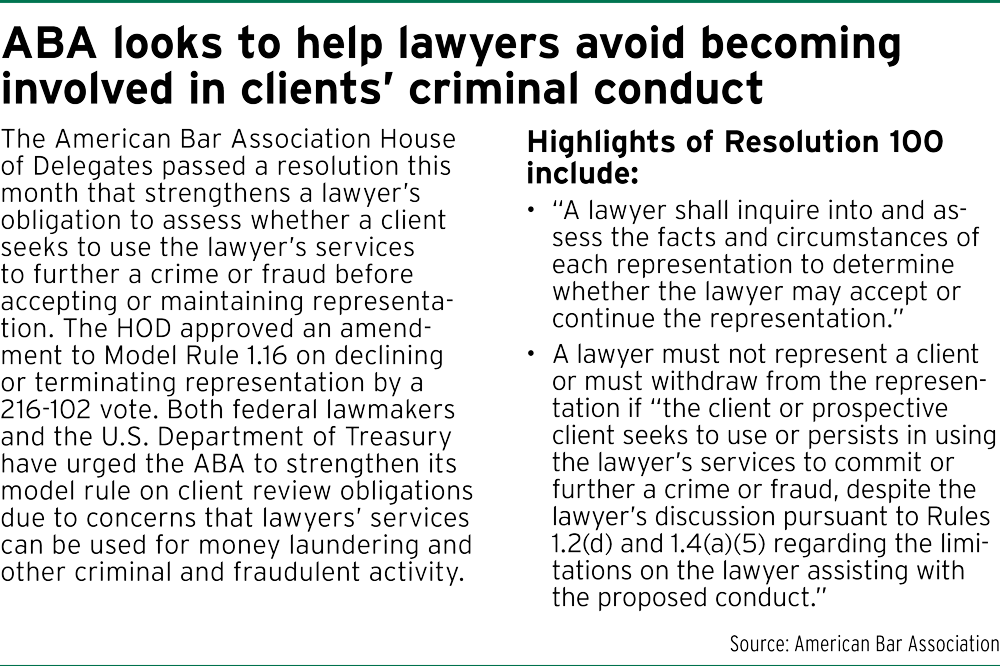

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowA resolution passed by the American Bar Association House of Delegates this month aims to ensure attorneys are vigilant about their clients and don’t unknowingly get caught up in a client’s criminal or fraudulent activities.

Resolution 100 is an amendment to Model Rule 1.16 of the ABA Model Rules of Professional Conduct, Declining or Terminating Representation.

According to the text of the resolution, the amendment makes explicit the nature and scope of lawyers’ existing obligations to inquire about and assess the facts and circumstances regarding each representation an attorney takes, and shows the federal government and the public that the legal profession takes seriously its obligations to not become involved in criminal conduct. That conduct includes money laundering, terrorist financing, human trafficking and human rights violations, tax-related crimes and other illegal activity.

The ABA’s House of Delegates passed the resolution by a 216-102 vote at its August meeting. Steven Hoar, a partner with Kahn, Dees Donovan & Kahn, was one of the Indiana State Bar Association’s delegates to the ABA meeting.

Hoar, who voted in favor of Resolution 100, said the resolution requires a lawyer to withdraw from representation if a client uses lawyer services to commit fraud or criminal activity. He said resolution proponents argued that it’s a lawyer’s duty to know their clients and to not assist a client in committing a crime.

“There was spirited debate on this resolution,” Hoar said.

Courts keep close eye on ABA rules

The ABA resolution and amended language to Model Rule 1:16 notes that a change in the facts and circumstances relating to an attorney’s representation may trigger a need to make further inquiry and assessment about their client.

As an example, the ABA cited the hypothetical scenario where a client traditionally uses an attorney to acquire local real estate through the use of domestic limited liability companies, with financing from a local bank. The same client then asks the lawyer to create a multitier corporate structure, formed in another state to acquire property in a third jurisdiction, and requests to route the transaction’s funding through the lawyer’s trust account.

As an example, the ABA cited the hypothetical scenario where a client traditionally uses an attorney to acquire local real estate through the use of domestic limited liability companies, with financing from a local bank. The same client then asks the lawyer to create a multitier corporate structure, formed in another state to acquire property in a third jurisdiction, and requests to route the transaction’s funding through the lawyer’s trust account.

“The obligation … continues throughout the representation,” a comment to the resolution says.

Hoar said states, including Indiana, generally regulate their own legal processes and professional rules of conduct.

State supreme courts do pay close attention to what the ABA Model Rules are, whether the bar association amends them and what those resulting language changes are, he said.

Kathryn Dolan, the Indiana Supreme Court’s chief public information officer, noted the court has a rules committee that meets regularly.

Dolan said she didn’t know if the committee was aware of the resolution that was passed in August or the amendment to Model Rule 1:16. But she added, “This is exactly the sort of thing the rules committee would look at.”

As far as the Indiana Rules of Court go, Dolan said generally, the Indiana Supreme Court considers many voices when adopting a new rule of court.

There is no set policy for the Supreme Court to consider the ABA’s, or other entities’, model rules or resolutions related to rules, she added.

“The Court has approached rule-making by listening to lawyers and judges (who can suggest rule changes), depending on the research and guidance of its Committee on Rules of Practice and Procedure, and eliciting feedback from policymakers and the public,” Dolan said.

She added, “There is no specific examination currently of ABA Resolution 100, but certainly a lawyer or other interested stakeholder could bring it to the Office of Judicial Administration with a request for it to be considered.”

Trying to get ahead of federal regulation

In its announcement of Resolution 100 and other resolutions passed at its HOD meeting, the ABA noted that both federal lawmakers and U.S. Department of Treasury officials have urged the ABA to strengthen its model rule on client review obligations because of concerns that lawyers’ services can be used for money laundering and other criminal and fraudulent activity.

Typically, that happens in a transaction when a client asks the lawyer to hold a substantial amount of money in a client trust fund for a business deal, only to ask for the money back later because the deal purportedly did not proceed, according to the ABA.

Hoar noted there was federal legislation proposed in Congress, called the Establishing New Authorities for Businesses Laundering and Enabling Risks to Security, or ENABLERS, Act, that would require attorneys to do something similar to bankers, who are required to report suspicious activity.

The ABA proposed Resolution 100 in the spirit of the states traditionally regulating the legal profession, he said.

“The ABA would like to keep it that way,” Hoar said.

Outgoing ISBA President Amy Noe Dudas said she would have voted for the resolution, but was sick the day of the delegates’ debate and vote.

She said the resolution was an effort to show the federal government that attorneys were taking the issues of representation and client conduct seriously.

“It’s somewhat the lesser of two evils,” Dudas said.

Debate highlights differences on resolution

Hoar said Resolution 100 was debated for about 90 minutes. He said delegates who were opposed to the resolution didn’t want an additional burden put on attorneys.

Dudas, who has attended four ABA delegate meetings, said there are usually only two or three resolutions at an ABA delegate meeting that are controversial.

Melissa Avery, an attorney with Broyles Kight & Ricafort and a HOD delegate for five years, said she also voted in favor of the resolution. Avery said it wasn’t on her radar prior to the delegate meeting, because the resolution’s focus doesn’t directly affect her practice area.

Opponents of the resolution were concerned it could require attorneys to disclose confidential client information to the authorities, Avery said, so they wanted more time to review the resolution’s language.

But Avery also said the resolution makes no requirement to turn over confidential information. She added lawyers should already be inquiring about representation.

“I think that’s important for any lawyer to do,” Avery said.

According to an ABA news release, Resolution 100 represents a second step in the bar’s efforts to protect lawyers from unwittingly becoming involved in a client’s or prospective client’s criminal and fraudulent activities.

In February, the HOD, which is comprised of 597 delegates, adopted a measure that endorsed for the first time “reasonable and appropriate” federal government efforts aimed at combating money laundering.

The policy seeks to balance the longstanding attorney-client privilege with the demands of governmental entities seeking access to information on criminal activities.•

Please enable JavaScript to view this content.